Industries

Industries

Japan’s Energy Sector and its Supercharged Benefits

By Priyanka Rana

In this article, we provide an overview of Japan’s energy sector, key statistics, consumption trends among consumers and businesses, highlight the major Japanese companies operating in the energy sector, specifically renewable energy, and how to get involved as a foreign company entering the market.

Overview of Japan’s Energy Sector

Japan is comparatively lacking in terms of its energy resources, for example; crude oil, natural gases, coal, nuclear power, hydro and renewable energy, which brings about low essential vitality. Japan’s self-sufficiency ratio was 7.4% in 2017, which is much lower than any of the other OECD nations. As the self-sufficiency ratio is low, there is a high degree of reliance on different nations to provide energy resources.

Being a highly industrialised country, Japan depends heavily on a reliable fuel supply. In recent years although energy consumption has decreased, the country is still one of the top primary energy consumers. After the 9.0 magnitude Great East Japan Earthquake and powerful tsunami struck, domestic nuclear power generators were shut down, and the requirements of the international climate change agreement have put Japan in a dilemma of seeking ways to obtain accessible and cheap energy whilst simultaneously reducing its carbon footprint.

The economic upturn after WW2 was largely fueled by the primary energy source, coal, which was mainly produced domestically. There was a strong growing need for energy in Japan’s iron and steel industry, and there was a shift towards cheaper oil. Resources were imported from overseas, predominantly from the Middle East, as oil reserves were exhausted very quickly.

The oil crisis of the 1970s affected the Japanese economy severely, leading to energy security being a central concern for the Japanese energy market ever since. The Japanese government led the development and implementation of different energy sources, including nuclear power and renewable energy during the 1970s and 80s, arriving at very nearly 30% of Japan’s total electricity consumption.

Due to reliability issues with the most punctual reactors they required long upkeep blackouts, with the average capacity factor averaging 46% more than 1975-77 (by 2001, the average capacity factor had reached at 79%). In 1975, the LWR (Light Water Reactor) Improvement and Standardization Program was propelled by Japan’s Ministry of International Trade and Industry (MITI) and the nuclear power industry.

This was pointed, by 1985, to normalize LWR structures in three stages. In stages 1 and 2, the current BWR (Boiling Water Reactor) and PWR (Pressurised Water Reactor) structures were to be altered to improve their operation and maintenance. The third period of the program included expanding the reactor size to 1300-1400 MWe and rolling out huge improvements to the structures. These were to be the Advanced BWR (ABWR) and the Advanced PWR (APWR).

A significant research and fuel cycle established through to the last part of the 1990s was the Power Reactor and Nuclear Fuel Development Corporation, also called PNC. Its exercises extended generally, from uranium exploration in Australia to removal of significant level wastes. After two mishaps and PNC’s unsuitable reaction to them the legislature in 1998 reconstituted PNC as the leaner Japan Nuclear Cycle Development Institute (JNC), whose brief was to concentrate on quick raiser reactor advancement, reprocessing high-burnup fuel, blended oxide (MOX) fuel creation, and elevated level garbage removal.

Be that as it may, the Fukushima Daiichi nuclear disaster in 2011, shut down the ascent of nuclear power and represented another misfortune in Japan’s energy strategy. Turning off all domestic nuclear reactors, the nation was by and by compelled to import larger quantities of oil and gas. As a result, the proportion of Japan’s independently sourced energy tumbled from around 20% in 2010 to 6% in 2014.

Environmental Considerations in Japan’s Energy Sector

Aside from energy security, the environment is another major issue in Japan’s energy market. In order to meet the 2015 Paris Climate Agreement goals, the government has emphasised private investments in the renewable energy sector. As a consequence, the share of renewable energy in the primary energy supply doubled from around 4.6 % in FY 2015 to approximately 8.7 % in FY 2018. The energy generating power of renewable resources increased drastically, with solar power accounting for the largest share. The large-scale installations of solar panels, however, requires deforestation which has recently provoked criticism around the environmental sustainability of solar power projects.

Business and Consumer Trends in Japan’s Energy Sector

The Japanese energy sector relies on fossil fuel power generation since nuclear power plants became almost inoperable after the damage caused by the Great East Japan Earthquake of March 2011. Still, Japan’s energy sector is actively trying to overcome this situation through home-grown renewable energy. Before the earthquake, the energy mix was 65% for fossil fuels, 25% for nuclear power, and 10% for renewable energy. In 2016, however, this ratio flipped completely to become 83% for thermal, 2% for nuclear and 15% for renewable energy.

In April 2015, the legislature reported that it needed base-load sources to generate 60% of Japan’s total power by 2030, with around 33% of this being nuclear. Analysis by the Research Institute of Innovative Technology for the Earth assessed that energy expenses would then be diminished by 2.4 trillion JPY ($20 billion USD) every year.

Simultaneously, 43 coal-fired power ventures were arranged or under development, totalling 21.2 GWe and were expected to transmit 127 million tonnes of CO2 per year. As with coal power recovery, at 20% expanded utilization, Japan’s LNG (Liquefied Natural Gas) imports expanded from about $20 billion USD in 2010 to $70 billion USD in 2013.

The Japanese government and industry players are actively working to balance thermal power to 56%, nuclear power to 20-22%, and about 22-24% for renewable power by 2030. By this time, usage of renewable energy is predicted to increase by approximately 40% compared with the figures in 2017. The power generation facility solar plans will increase by approximately 25 GW, from 39.1 GW in 2017 to 64 GW by 2030. The expected growth rate is about 200% for wind power and 130% for biomass.

Successful Innovations in Japan’s Energy Sector

Much like Silicon Valley’s software blitz scaling approach, Japan’s energy sector is looking at software-based business models, keen to invest in commercially developed solutions that employ Artificial Intelligence (AI) & Machine Learning (ML). Technologies which can be quickly deployed into the home market are attractive compared to hardware solutions where the need for channel partners, certification and regulation create deployment constraints.

The Japanese government and the nation’s electric companies have pushed hard for RPS (Renewable Portfolio Standard) over FIT (Feed-in Tariffs), as they stick to the customary approach authority channels (led by the United States) preferring market-based models. The ideological culture along these lines wouldn’t copy the European model, as this would essentially affect Japan’s sustainable power sourcing and pose a danger to the establishments necessary to maintain business as usual.

Virtual Power Plants (VPP)

The energy market in Japan has some of the biggest VPP market potential in the Asia Pacific region. Their robust grid infrastructure, renewable goals, and significant capacity demonstrates that additional value already exists. Still, the rest of the Asia Pacific region suffers from intermittency, regulatory barriers, and lack of infrastructure.

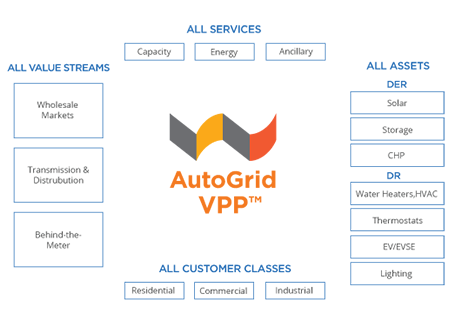

Recently, software innovator AutoGrid established a subsidiary in the Japanese energy market named AutoGrid KK, to serve utilities and retailers looking to deploy flexibility management solutions. The company offers SaaS products which help Japanese energy players to leverage proven VPP capabilities.

Vehicle-to-X (V2X)

Vehicle-to-X innovation has become progressively well known in nations with a generally high and developing level of renewable energy, with utilities inspired by V2X as a choice to adjust to the impact of electric vehicles and renewables on the grid.

TEPCO invested $2.5 million USD in Fermata Energy, a vehicle-to-building software organisation which permits clients to decrease the pinnacle power request in their structures by utilising the on-board batteries of the client’s electric fleet vehicles, making money while they are idle. TEPCO considers vehicles to be another DER (Distributed Energy Resource) which can be utilised to help balance the grid, and implemented as an approach to draw in new clients.

Distributed Resources Management Systems (DERMs)

Some areas of Japan have an abundance of high capacity solar and wind power generators. Combined with low demand, has opened the energy markets to pricing vulnerabilities. The use of DERMs will become more vital to maintaining system balance. There are growing opportunities for leading DERMs providers such as Enbala and Opus One Solutions, who are closely monitoring the Japanese energy market.

Japan’s Renewable Energy Market

Japan’s energy sector is prioritizing “Energy Security”, while improving “Economic efficiency”, pursuing “Environment” and “Nuclear safety” is the primary concern. The “3E + S” policy targets are as follows:

- Energy Security—in FY 2013, the energy self-sufficiency rate was 6.5%, and the target self-sufficiency rate is to reach 25% by FY 2030.

- Economic efficiency—in FY 2013 electricity costs surged due to fossil fuels costs, Feed-in-tariff (FiT) and grid integration of renewable energy. This is aimed to be lowered by FY 2030.

- Environment—in FY 2013 Greenhouse gases (GHG) emissions were at their worst level.

Despite the fact that Japan has been focused on decreasing its carbon output for quite some time, existing energy authentications and carbon credit frameworks are confounded and divided, even in the best case scenario. For Japanese organisations looking to move their energy security to the renewable sector, the multifaceted nature is presenting additional problems in terms of high implementation cost of renewables.

Issues in Japan’s Energy Sector

The rising price for industries means increasing cost for companies, negatively influencing their performance. The rising price for households starts to jeopardise affordability for ordinary people, damages people’s consumption incentives, and eventually reduces people’s quality of life. Toyota has just launched the new generation of its Mirai (future) hydrogen fuel cell vehicle.

The new Mirai not only has zero emissions, but also can produce and store electricity to provide energy in an emergency. This Toyota vehicle doesn’t just consume energy, but also supplies it. Mirai points to the future for Japan’s energy policy. Similar innovations should take place in other industries.

Storage of power

The development of battery facilities is important to explain the issue of power transmission proficiency, just as would be utilised during a power outage. Among the sustainable power sources, solar based force and wind power are hindered by the fact that the measure of power generation relies upon climate conditions and is therefore hard to control. “Battery storage” is commonplace as a device that takes care of the issue of sustainable power source insecurities. “Batteries for power grids” are utilised by linking to the power grid (the entire power framework, from power plants to transmission and distribution).

When this large scale storage battery is associated with a sustainable source power plant or mains system, it can balance out grid power by charging when energy is sufficient and releasing when energy is lacking. The Japanese government is supporting research to demonstrate the effectiveness of these battery storage systems.

High cost of energy generation

Generating renewable energy in Japan costs twice as much compared to most European countries and the method of facility procurement needs to be changed. Following the introduction of feed-in-tariffs (FIT) in July 2012, the implementation of renewable energy has been rapidly progressing, but compared to international standards, the cost of power generation remains high. Japan’s energy sector needs to generate renewable energy as a cost-competitive power source by making significant cost reductions and spearheading new innovations.

Lack of advancement in biomass power generation

Japan has gigantic wooded areas which have not yet been tapped into successfully because of low levels of attractiveness. It is hoped that the development of numerous new biomass plants will be expanded. Biomass power generation should be promoted in relation to farming and forestry services in local areas. Japan needs to resolve various issues, for example, how to manage situations where companies depend on imported energy, and how to readily secure biomass.

Offshore wind power

To secure new power plant sites, offshore sites must be developed alongside the technologies and energy sources from competitive facilities. The “Act on Promotion of Utilization of Sea Areas Related to Development of Marine Renewable Energy Power Generation Facilities (Renewable Energy Sea Use Law)” was enforced in April 2019. This new act paved the way to resolve the issue regarding the occupation of marine areas to coordinate the interests with those using marine areas, such as fishery and ship operators.

Key companies in Japan’s energy sector

TEPCO (Tokyo Electric Power Company)

TEPCO has been one of the most progressive corporations in the Japanese energy sector, drawing on worldwide advancement by means of assets, and venture investment. The group set up a corporate funding arm in 2018 with capital of 5 billion yen to connect with local and overseas advancement, and has since made seven cleantech ventures including new businesses, for example, battery virtual energy plant supplier, Moixa distributed energy exchange player, Electron, and vehicle-to-building trend-setter, Fermata Energy.

The gathering has likewise upheld a few cleantech energy assets in 2019, including the Southeast Asia fund overseen by Cleangrid Partners. These vital commitments are helping TEPCO keep pace with mechanical advancements in their home market and empowering them to expand and investigate new markets.

KEPCO (Kansai Electric Power)

Deregulation of the energy market in Japan is making the competition between power organisations more intense. The way to become a ‘viable supplier’ for clients is to build on reputation and coordinate their electric energy needs. KEPCO utilises information from smart meters to recognise how consumers live.

At the point when a consumer’s power use seems different than usual, a message is sent to advise their family, who might be living somewhere else. This is the idea behind KEPCO’s “Way of life Rhythm Notification Service.” Following field tests untaken in conjunction with electronics giant Fujitsu, KEPCO has begun offering this support service, which makes use of Artificial Intelligence (AI)- based developments.

“When utilising AI and other advanced technologies, it is more important than ever to strengthen collaboration with partners who have specialist expertise. We wish to provide increasingly high-value-added services, based on alliances with companies in sectors that serve individual households face-to-face; such as home delivery and home-visit nursing care.”

Reijiro Matsui—Customer Relations and Services Division, KEPCO

Chubu Electric Power

Chubu Electric Power (Chuden) is a Japan-based organisation essentially involved in the power and energy business. The company has three business sections. Firstly, the Power Generation department focuses on the arrangement of intensity from warm energy and sustainable power sources.

Secondly, the company is also engaged in the telecommunication construction business, the advertising, leasing and insurance agency business, the construction, inspection and repair of electrical facilities. Lastly, the Sales facility is occupied with the far reaching energy administration, including offering melted petroleum gas and energy, as well as the planning, activities and upkeep of energy offices.

Kyushu Electric Power

Kyushu Electric Power (Kyuden) takes part in the arrangement of electric capacity to private and business. It works through the accompanying portions: Electric Power, Energy-related, Information Technology (IT) and Telecommunications, and ‘Other’.

The Electric Power department manages the energy flexibility business, the Energy-related section incorporates getting, putting away, and providing condensed gaseous petrols and different energy organisations. Mitsui & Co., Ltd. will conduct a joint pilot project with Kyushu Electric Power Co. Inc. to form a new service for residential customers coming off FIT (feed-in tariffs). This project uses batteries controlled and aggregated by a VPP (virtual power plant) software platform provided by Sunverge Energy, Inc., a US-based energy company.

Is Japan Asia’s Biggest Energy Market Opportunity?

Japan’s energy market was certainly in a depressing place in 2011, yet today the country is broadly considered to be one of the greatest market opportunities for new energy advancement. Both familiar and unfamiliar pioneers are hoping to profit by rising their chances of success in Japan. New businesses and players with established client bases are entering the market, to maximise their reputation.

Within the space of a couple of months, Global Cleantech 100 organisations; Moixa Technology, AutoGrid and LO3 Energy have had new associations in the Japanese energy market. The quick reception of retail rivalry, deregulation, sustainable power sources and behind-the-meter sunlight based energy storage is opening new doors for energy pioneers.

After the Fukushima Daiichi disaster, Japan’s nuclear fleet was shut down and supplanted with more costly petroleum derivatives, prompting higher power costs. This expanded the force to embrace new proficient innovation and plans of action. Which thus observed many new deregulated energy retailers entering the market. Japan’s legislature has likewise ordered a close to multiplying of sustainable power source age by 2030, diminishing ozone harming substances by 26% contrasted with the 2013 sums.

UK-based trend-setters are effectively steering their own course and banding together with Japanese organisations. This is no coincidence. Given that the nation was deregulated, harking back to the 1990s, new companies have had the opportunity to comprehend the difficulties of market change, and therefore Japan has been quick to learn. The UK’s dynamic controller has opened doors to empower matrix advertising partners to use incorporated energy in adaptability barters, giving them the choice to arrange redesigns.

In June, GreenSync, Smarter Grid Solutions and Nexant reported designs to empower 500MW of adaptability for UK power systems. Japanese energy players are looking to the UK to better understand how the adaptability limit markets work. UK trailblazers, for example Moixa have set up another traction in Japan, entering the Japanese market a year ago in partnership with Itochu. The organisation has incorporated its GridShare programming into the Itochu’s Smart Star batteries and oversees 60 mwh of battery limit across 6,000 homes across Japan.

See also:

Expand into Japan’s Craft Beer Sector: Overview, Obstacles and Opportunities

Ways to Break into Japan’s Organic Market

We’ll be adding more articles on food & beverages in Japan in the future, so keep checking back or follow us on LinkedIn, Facebook or Twitter to get notified about our latest posts!

Alternatively, get in touch to see how we can help you collaborate and do business with Japanese energy companies