Industries

Industries

Growth and Innovation: Overview and Opportunities of Agritech in…

By Samuel Arnold-Parra

What is Agritech?

As the name implies, ‘agritech’ is the intersection of agriculture and technology. Agritech, sometimes referred to also as agrotech, refers to the application of technology of all kinds to make farming easier and more efficient. Agritech encompasses a vast range of different technologies, ranging from advances in hydroponics and drone technology to the use of AI and data analytics for monitoring crops. Globally, the agritech market is set to grow in both size and importance as societies increasingly seek sustainable and effective methods of cultivation in the face of issues like climate change.

Need help with marketing in Japan? Contact us

The Value of Agritech for Japan

As of 2020, the average age of individuals engaged primarily in agriculture in Japan is roughly 68 years old. In addition, the number of people involved in farming is on a downward trend. From roughly 2 million people in 2010, Japan’s agricultural working population fell by 34% to around 1.3 million in 2020. To help counterbalance Japan’s dwindling and aging agricultural workforce, agritech could be leveraged to automate more agricultural processes and make them less taxing on the individual.

Japan’s agricultural costs of production are high compared to various other countries, owing to the high cost of agricultural inputs like fertilizers and agricultural machinery. Looking at 2021 statistics related to rice production, Japan’s main agricultural product, it costs on average ¥9180 JPY (£58.67 GBP at the time of writing) in overall input costs per 60kg of rice produced. 13% of this figure is comprised of fertilizer costs, and another 32% by the costs associated with agricultural machinery and tools. Consequently, developments in agritech which reduce fertilizer wastage or alleviate machinery-related costs would assist Japanese farmers greatly.

Want to learn about how Japan’s changing demographic landscape has affected other Japanese industries? Click here

For businesses seeking straightforward help on your expansion into Japan, our expansion plans do the heavy lifting to grow your business in a new market. Contact Tokyoesque.

Japan’s Agritech Market

The history of Greenery Day is complex, tracing its roots back to the birth of Emperor Shōwa in 1901, in part because of According to the Yano Research Institute, Japan’s agritech market size was estimated at over ¥26 billion JPY (approximately £166 million GBP) as of 2020. Moreover, it was forecast that the market’s scale would double by 2026 to over ¥54 billion JPY, driven by factors like continued agricultural workforce decline and advancements in telecommunications such as 5G.

Making use of a broad range of technologies, Japan’s agritech firms deal in a wide variety of products and services, many of which aim to mitigate the challenges detailed earlier. Looking over the market, key subsectors which stand out include sales and resource management platforms, drones, robots and systems to help with cultivation and animal husbandry.

Aiming to counteract the decline of Japan’s shrinking agricultural workforce, Agrimedia developed its online “Agrinavi” platform which aims to make it easy for farms to manage their human resources and hire new workers, particularly those in their 20s and 30s. The platform boasts over 800,000 members, cooperating with prefectural governments to organize career events both in person and online. The company also operates a service which uses otherwise fallow land as “share farms” and agricultural parks with the goal of not only maintaining agricultural land but supporting local communities and increasing public interest in farming.

Agricultural robots show a lot of promise for Japan; a 100-hectare farm in Shizuoka reported a 72% decrease in the time necessary for ploughing and hilling after introducing self-driving tractors as part of a government sponsored project.

Yanmar Holdings, a notable company in this space, started production of robotic tractors in 2013 and received government recognition for their work in the form of an award from the Ministry of Agriculture, Forestry and Fisheries (MAFF) in 2016. Further highlighting Yanmar Holdings’ contribution to the promulgation of agritech in Japan, it was actually their self-driving machinery which was used at the aforementioned farm in Shizuoka. Numerous Japanese agritech startups have also emerged in recent years, indicative of growing interest in the potential the sector holds.

In the realm of cultivation and animal management systems, various companies offer services which leverage sensors, the cloud and data analysis to assist farmers. One example from the perspective of crop management is the “Green Monitor” (みどりモニタ) sold by IT company Seraku, which intends to provide farmers with a cheap and easy-to-understand way to keep track of important variables like temperature, pH or moisture levels.

Another example is U-motion, a product created by DESAMIS Co. to monitor cows by using a range of sensors to inform farmers of the health and movements of their livestock. One technology which appears under-explored in the Japanese agritech management systems space is blockchain technology. Though a number of blockchain start-ups are active in agriculture in other countries like the United States and India, an opening exists for a Japanese or overseas agritech firm to apply blockchain technology to Japan’s agricultural sector.

Interested to learn how 5 Japanese companies are implementing SDGs and innovating in the field of sustainability? Click here.

Opportunities for Business

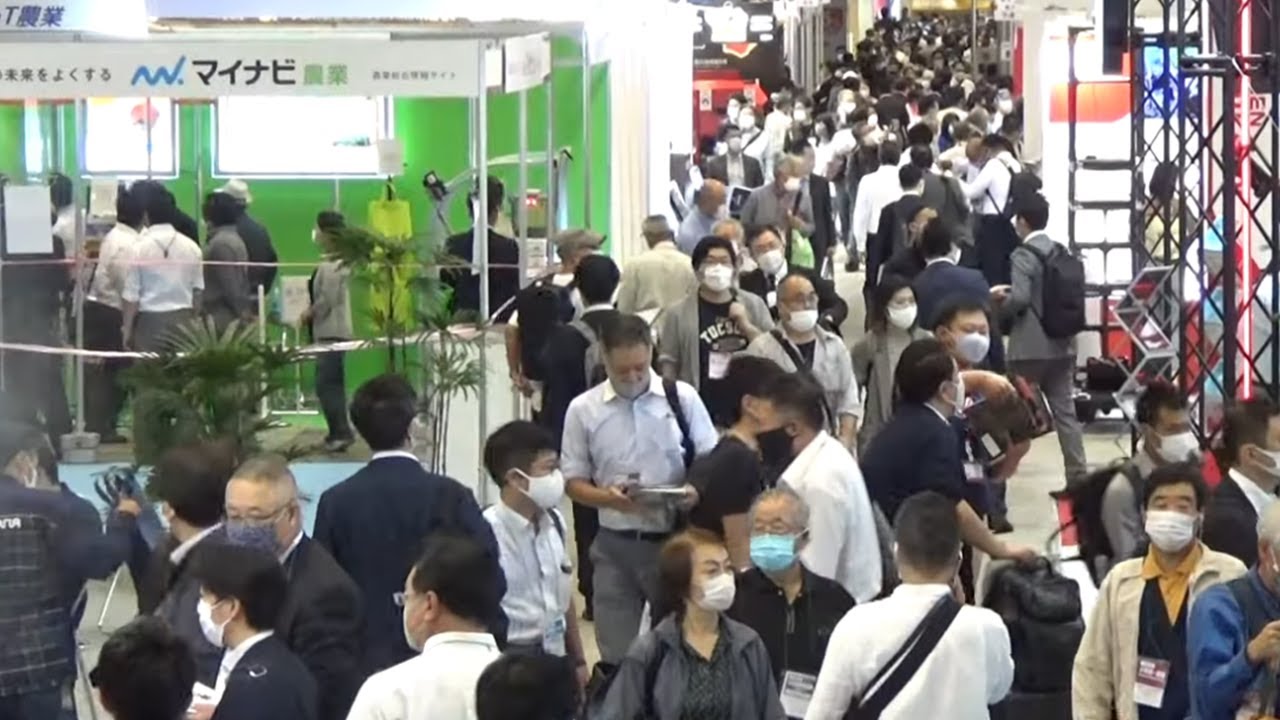

Opportunities for international investment and collaboration on agritech between Japanese and overseas firms are on the increase. Among the best options for business-to-business networking in the agritech space are the International Material & Technology Expo and the related Next Generation Agriculture Expo, held annually in both Tokyo and Osaka. 2020’s Tokyo exhibition received over 23,000 visitors and saw the participation of over 300 exhibitors, providing ample opportunity for negotiation with parties ranging from farmers and wholesalers to local government representatives.

The AG/SUM agritech summit is another avenue for connection with Japanese firms in the agritech space; compared to the International Material & Technology Expo, AG/SUM focuses more strongly on start-up companies in Japan’s agritech space, making it a good choice for those interested in agritech investment.

The Japanese government has also taken a proactive stance towards cooperation with overseas firms as a consequence of its “Plan to Promote the Establishment of Global Food Value Chains”, introduced in 2019. As part of this plan, Japan’s MAFF seeks to expand Japanese food and agriculture firms’ overseas business operations by facilitating joint ventures with overseas firms and encouraging interaction between domestic and overseas businesses in this sector. Supporting the deployment of Japanese agricultural technology overseas is also part of this plan.

Want to learn more about the Japanese preserved foods industry? Click here.

This article was written by guest writer Samuel Arnold-Parra.

LinkedIn: https://www.linkedin.com/in/samuel-arnold-parra-2899721b6/

Interested in understanding more about how to create appeal among Japanese consumers with limited-time or seasonal offerings? Get in touch with us to discuss how your brand could boost visibility using a carefully considered marketing strategy.

Keep checking back or follow us on LinkedIn or Twitter to get notified about our latest posts. We’ll be adding more articles on technology developments and various sectors in Japan, so watch this space!