Industries

Industries

Revolutionary Digital Solutions in Japan and the Transformation of…

By Melissa Francis

This article is a follow-up to our recent look at digital signing solutions in Japan. Here, we take a step back and delve into the broader uptake of digital solutions in Japan, exploring some of the issues faced by Japanese SMEs as well as the trends and solutions helping them make the switch from analogue to digital.

Overview: Digital Solutions in Japan

Japan may be considered as a developed, hi-tech nation by many, but there are still areas where the country has lagged behind its global counterparts. Notably, Japanese businesses are known for having prolonged the period of time where fax machines were still commonplace. Despite being pioneers in certain fields, for instance NFC payments in the forms of cashless cards like JR East’s SUICA, there are countless examples of Japan’s reluctance to do away with more traditional, analogue methods.

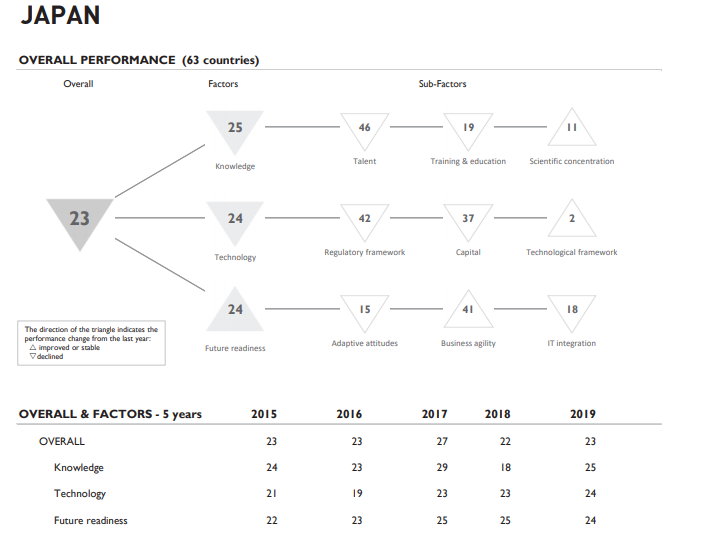

According to an annual report published by IMD, last year Japan ranked 23rd out of 63 countries in terms of its digital competitiveness, with ‘scientific concentration’, ‘technological framework’, and ‘IT integration’ faring especially low on the scale. So there is most definitely room for digital solutions in Japan to develop and be more globally competitive.

The Fintech sector is a prominent example of the lag in terms of digital solutions in Japan; this was a market that had been slow to grow in the beginning, but is now developing and innovating at a good pace. Japan’s Fintech sector also encapsulates the burgeoning arena of blockchain technology, a solution which has seen a spike in utilisation across a range of industries, most prominently in finance and entertainment.

But it isn’t only the customer-facing technologies that Japanese SMEs have the challenge of working with. They also need to ensure that their digital backbone is strong enough to support the smooth running and easing up of business processes that are still being done manually. Japan’s ageing society and dwindling workforce means the pressure to digitise certain operations is even more evident.

While larger Japanese corporations have more extensive budgets and resources to implement new technologies, this remains a relative struggle for SMEs. In order to future-proof their businesses, there is a requirement for Japanese SMEs to adapt and thrive at using advanced digital solutions. The problem is, not everyone understands how to go about achieving this.

Problems with Implementing Digital Solutions in Japan

A Japan Information Systems and Users survey conducted in February 2020 found that while half of Japanese SMEs were considering, or had decided to implement digital products and services, 70% were choosing to implement digitised business processes to replace the manual format. So, there’s a stronger propensity for Japanese SMEs to perceive that there is a requirement for internal digital transformation. There appears to be a disparity between the realisation of advanced technologies for internal purposes, and putting out offerings for customers that rely on new tech.

Electronics corporation RICOH ran a survey which revealed that companies with less than 300 employees were far less likely to have considered or implemented IoT or AI solutions. On the other hand, companies with more than 300 employees were more adept at utilising data obtained from their IoT infrastructure and using it to inform management decisions, compared with smaller firms.

The obstacle holding SMEs back from effectively adopting digital solutions in Japan often comes in the implementation stage itself. Usually, the physical demand has already been considered and identified by management, but a lack of knowledge and experience result in two core problems:

It’s challenging to introduce digital solutions in Japan

Representatives are not introducing advanced technologies for purposes that will benefit the company, or are not pinpointing where the real issues exist that need to be digitised. Proof of Concepts have been put forward without evidence that it would be the right decision for the company’s wider business plan. There has been a need to fully quantify the future value of implementing technology like AI or IoT in terms of the cost and time saving. Unfortunately, in many cases, those responsible for introducing digital technologies into Japanese SMEs are often trying to solve problems that don’t need solving, or they’re simply looking in the wrong place.

It’s difficult to plan and schedule digital solutions in Japan

Many Japanese SMEs also have trouble in setting out a clear budget and timeline for the implementation of digital technologies, particularly when there is no method of comparison. If the technology is completely new, time also has to be spent on figuring out how best to connect the technology effectively with existing personnel, systems and processes. And because this does take time, digital solutions in Japan aren’t always put in place when they are most needed.

Foreign Players Offering Digital Solutions in Japan

DottedSign by Kdan Mobile

Kdan Mobile expanded to Japan in August 2019 in a strategic partnership with Sourcenext in order to bring a PDF app solution for Android to users of Softbank’s App Pass. Sourcenext has also helped a range of other brands enter the Japanese market, including Rosetta Stone language learning, and Evernote cloud documents.

DottedSign is Kdan Mobile’s e-signature solution and has been localised into a number of languages, including Japanese. DottedSign was initially introduced with a 90-day free trial offer available from June 2020 so that potential paying users in Japan could test out the functionality. The e-signature platform is being promoted as an essential tool for teleworking.

Kenny Su, Founder & CEO of Kdan Mobile says:

[DottedSign] is a new product of Kdan’s, launched in mid-2019. We started out developing this new product with the concept of bringing e-signatures to Asia. While e-signatures have been in a trend for years in the west, in Asia, the culture of personal stamps or company seals on paper has been a barrier of such digital transformation. We also pride ourselves in the more user-friendly UI design, which, when compared to those of bigger companies, is easier to understand and integrate into their daily workflow.Japan is one of the largest markets in the world for apps and for SaaS services, but the e-signature penetration rate is still low and has a lot of potential. Plus, during the COVID-19 outbreak, there’s a need for the quick adoption of remote working tools to support a dynamic workflow. Therefore, we would like to bring our services into the Japanese market to support those needs”

Enevo

Founded in 2010 and headquartered in the US and Finland, Enevo presents an all-inclusive IoT solution for SMEs to manage garbage and container collection times. Sensors are placed inside containers, such as bins, clothes collection points and industrial drums to measure capacity and determine when it needs to be emptied. Not only does the platform provide this information, it also plans the most efficient times and routes for collection. Enevo expanded to Japan in 2015 and has a fully localised website with examples of how the service can be used within the specific cultural context of Japan.

Mobile communications giant NTT West implemented Enevo’s system across western Japan in order to fulfil their objective of reducing CO2 emissions. The results won NTT an award from the Ministry of Internal Affairs and Communication, as they managed to decrease their emissions and mileage by 20%. The technology has also been used by engine oil and lubricant manufacturer FUKUDA Corporation to keep on top of its oil tank levels. Although these examples are of larger firms, Japanese SMEs could also make use of Enevo’s sensors for a range of other purposes.

Local Companies Broadening Digital Solutions in Japan

Various Technology Solutions: JSD

Founded in 1974, Japan System Development (JSD) is a long-running specialist in developing advanced technological solutions for companies of all sizes, including Japanese SMEs. With 60 employees, JSD is also an SME, so understands the needs of its clients well. Their available offerings cover various business departments including management support, retail inventory, sales data analytics, manufacturing, licence management and more. JSD prides itself on its ability to be flexible and speed-oriented while being committed to investing in next-generation technology, such as sensors.

The company’s CEO, Hideshi Kaneoka, believes that because Japan is facing rapid globalisation, he is aware of JSD’s ability to continue learning about the latest technology and developing fresh solutions that will eventually lead to computers and humans becoming inextricably ‘fused’ and co-dependent.

AI Data Analytics: Keywalker

Keywalker‘s data analysis service provides a consistent solution from data collection, storage, data visualisation through the use of business intelligence tools, data analysis with AI technology, and implementation of a data operation environment according to individual customer needs. There are also features like sales forecasts which can inform future strategy. The company’s data scientists provide high quality, consistent customer service, and as a result there has been a lot of support from those customers. The analytics service has been introduced across a wide range of industries and as of November 2019, more than 400 companies are using it, primarily large corporations such as Rakuten, Panasonic and NHK.

Case Studies Demonstrating the Successful Implementation of Digital Solutions by Japanese SMEs

AIDEM Recruitment

SoldOut is a company that specifically assists Japanese SMEs in their digital transformation, from digital marketing analysis to web development and HR solutions. They have 21 offices across Japan. The company’s offshoot, SO Technologies, develops the technology in-house to support the digital growth of Japanese SMEs. SoldOut worked with recruitment firm AIDEM to transform the way recruitment ads were put out online on Google and Indeed by using their ATOM solution.

This enabled AIDEM to change the way recruitment ad packages were put together for their clients as well as creating progress tracking reports. Implementing this reduced the number of staff hours by 80%, freeing up time and energy for representatives to focus on providing higher quality customer service. Ultimately, for an agency that handles more than 1,500 client accounts, SoldOut’s digital solution was worth bringing in, saving both time and money.

Ise Ebiya Cafeteria

Ise Ebiya, a company that runs a cafeteria in front of Ise Shrine. It has 45 employees and a capital of 5 million JPY. In the past, the number of customers visiting the store could not be predicted ahead of time, which resulted in a large amount of food loss and employee exhaustion. This pattern became the norm. When the current president, who used to work for a major IT company, joined the company, he decided to make the ability to accuracy predict customer flow as a priority. To do this, he proposed introducing an AI solution.

Once implemented, the AI enabled accurate “customer prediction” calculated from 150 types of data, reducing food loss and employee workload. Equipped with this new information, they quadrupled their sales, employees were more productive and they could take more time off during the week, all without needing to take on any extra staff members. As a knock-on effect, Ise Ebiya was also able to improve the quality of their overall customer service and put in place new sales measures.

How can SMEs Effectively Implement Digital Solutions in Japan?

There are a number of steps SMEs can take in order to effectively implement digital solutions in Japan that will accelerate their overall business processes. According to Takahiro Furusawa of the Japan Research Institute there are two measures Japanese SMEs can adopt if they are struggling. He believes that smaller companies can catch up to corporations in terms of demonstrating their advanced digital prowess in the not-so-distant future.

Firstly, there needs to be correct recognition of where the source of competitiveness is in terms of the company’s processes. Even if IT is advanced in an area which makes it simple to introduce new technologies but has a weak impact when it is achieved, the benefits will be limited.

Secondly, SMEs should work on the improving in-house organisational structure and cultivating the kind of corporate culture that welcomes digitalisation while being flexible in responding to unexpected situations.

Instead of attempting to execute a large plan from the outset, Furusawa advises starting small, continuously reviewing the outcome internally, and making necessary changes more quickly. Ultimately, a shift in mindset and reassessing how teams work together can help Japanese SMEs overcome the barriers to digitisation in the long-term.

Companies like JGoodtech connect Japanese SMEs with overseas organisations that can help ramp up innovation and development in various business areas, including digitisation. JGoodtech has a network of more than 7,300 foreign companies and 17,000 domestic Japanese companies, including around 500 leading corporations.

Keep checking back or follow us on LinkedIn, Facebook or Twitter to get notified about our latest posts!

Alternatively, get in touch to see how we can help expand your digital solution to the Japanese market.