Consumer Insights

Consumer Insights

Growing Trends of Personalised Beauty in Japan 2022

By Giulia Ferraro

Kindled by the power of the internet and social media, the beauty industry has grown exponentially on a global level, driving trends like that of “personalised beauty” in Japan. Nowadays, it is easy for anyone to view and purchase beauty products from abroad. Japanese cosmetics companies are often considered some of the top beauty manufacturers, popular amongst both domestic and international consumers.

In this article, we give an overview of the Japanese beauty industry, and go into the trend of personalised beauty that has been gripping the country.

Beauty Industry Overview

In 2022, the revenue in the Japanese beauty and personal care market amounts to US$41.98bn, and it is expected to grow annually by 5.40% (CAGR 2022-2026). Leading beauty companies in Japan include Shiseido, Kosé, Pola Orbis, Kao and Fancl. Japanese consumers are known to value high-quality products, with women and men willing to spend that extra money on products that deliver results. Similar to the West, the increased awareness of health and sustainability has made natural and organic beauty products popular with Japanese consumers in recent years.

The rise of conversations surrounding diversity and inclusion have also affected Japanese consumers, with personalised beauty services that offer skin-tone matched colour palettes, signifying a shift away from a “one size fits all” approach to a more individualised one that accounts for diverse experiences.

Post-Covid Japan Beauty Boom

With facemask mandates, the ‘natural no-make makeup look’ was popular during the height of the pandemic, but Japanese consumers in 2022 are now embracing a bolder, more colourful range of cosmetics. This colourful shift underscores a sense of celebration: after two years of cautionary behaviour and staying at home, young Japanese consumers are more willing to experiment with colour.

Want to gain a wider knowledge of the Japanese consumer landscape? Click here.

Personalised Beauty in Japanese Cosmetics

The restrictions during the pandemic have also meant that people have had more time to focus on themselves. Interestingly, one of the emerging trends we see in Japan is the focus on ‘YOU’ – that of personalised beauty. For example, conducting a ‘Personal Colour Test’ is incredibly popular right now. For around £100, an individual can see a ‘Personal Colour Specialist’ who will assess the individual’s colour palette based on their skin tone.

According to these specialists, people can be categorised into four colour types: Yellow Spring, Yellow Autumn, Blue Summer and Blue Winter. Depending on your category, different shades of colours supposedly suit you better. Interestingly, the popularity of the Personal Colour Test has been greatly spurred by Japanese YouTubers, who film themselves getting the test done for their viewers.

Want to learn more about the Japanese beauty/skincare market? Click here.

From their results, an individual will be able to identify and purchase the right shades of make-up. The Japanese beauty industry is aware of this trend as publications like Vogue Japan has articles dedicated to each type, listing out which items are best suited for each type respectively. Many young people follow their own type’s make-up hashtag (for example, #イエベコスメ – which means #yellowbasedcosmetics) to keep track of new beauty products or make-up tutorials that are best suited for them.

In this way, beauty has become a more personal and individual experience: it is less about following make-up looks that look good on celebrities, but rather identifying which products bring out the best of your features.

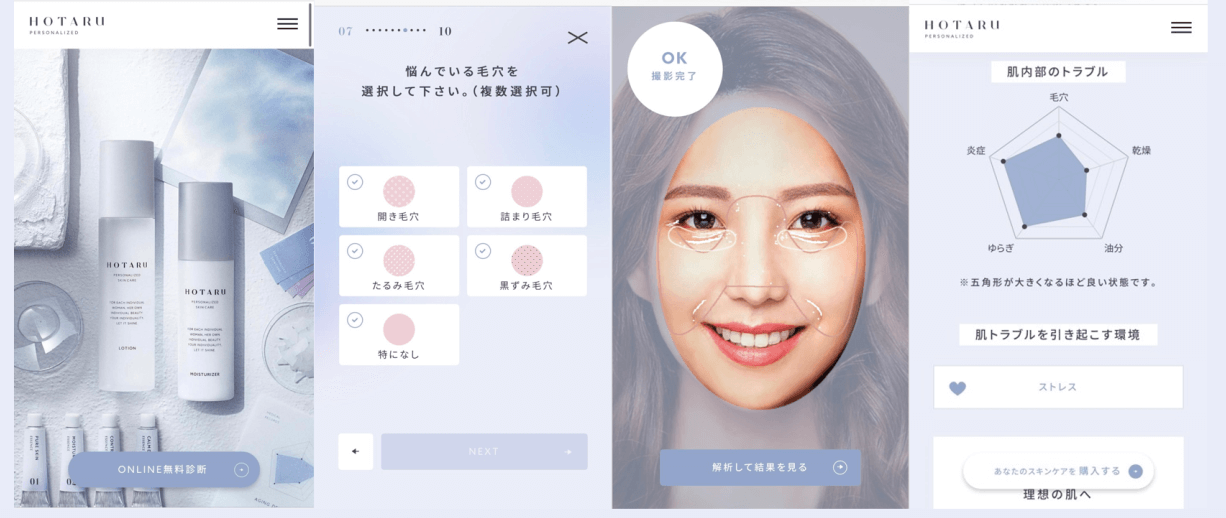

Jumping on this bandwagon of personalised beauty, L’Oreal recently acquired a minority stake in Japanese beauty brand Sparty Inc. Sparty is leading in Japan’s direct-to-consumer personalised beauty market, both in haircare (Medulla) and skincare (Hotaru). Consumers simply need to fill out a quick and easy survey online describing their hair or skin condition, before they are given a unique assessment and formula, which has been made for their own specific needs.

Want to learn how Japanese beauty brands use Valentines Day to drive sales? Click here.

Big Changes in the Japan Beauty Industry

The ‘one size fits all’ model is decidedly outdated in Japan. With the rise in conversations surrounding diversity and inclusion, it is clear that these broad topics have also been infused into the beauty industry. The focus is all on the individual consumer, and many emerging trends and innovations in the Japanese beauty industry are now based on this concept of personalised beauty.

To plan your business’s penetration into the Japanese beauty market, get in touch with us to arrange a free 30 minute consultation.

Interested in understanding how to create appeal among Japanese consumers with limited-time or seasonal offerings? Get in touch with us to discuss how your brand could boost visibility using a carefully considered marketing strategy.

Keep checking back or follow us on LinkedIn to get notified about our latest posts. We’ll be adding more articles on technology developments and various sectors in Japan, so watch this space!