Business

Business

Not just chocolate – how top Japanese beauty brands…

By Kajal Gosain, Edited by Honoka Karikomi

During this season, the Japanese beauty sector creates many “limited” items to attract customers: namely, the Valentine Commercial War. Japanese beauty brands target those who plan to send gifts to their partners on Valentine’s and savvy consumers who are attracted by the limited items. With a consideration to the sales growth in the beauty sector in Japan due to Covid, it can be expected that this year, the Valentine Commercial War will be even more intense. In this blog, our guest writer Kajal Gosain provides her view to the highly competitive Japanese beauty sector and Tokyoesque will provide insights on how non-Japanese beauty brands can be more competitive in the Japanese market.

Valentine’s Day in Japan – going beyond chocolate

In the western world, it is common that men give women presents, but Japanese Valentine’s Day looks a bit different. Women are the ones who give gifts to their lover, and also have the task of buying “giri choco” (chocolate for friends, colleagues, male family members). A month later, you have “White Day” where men send gifts to women in return for the gifts and chocolate they received on Valentine’s Day. It is also not unusual for women to spend money on beautifying products too, such as lingerie and cosmetics.

You might also find this post interesting: Japanese valentine’s day 2022 sales predictions: The New Normal for Valentine’s Day in Japan

4 Japanese beauty brands for people at every stage of their life:

1. SHU UEMURA

The beauty brand loved throughout the world, Shu Uemura is a name everyone must know by now. You’ll find their products to be far cheaper in Japan. They believe that great makeup begins with beautiful skin. The brand is not only loved by the people of Japan but also around the globe. They are currently running a Valentine’s Day campaign: from February 1 to 14, customers who spend more than 6,600 yen (equivalent to 42.62 GBP) at the official online shop will receive a gift item with a special Valentine’s Day design. On their website, not only do they talk about the campaign but also provide Valentine’s Day makeup tutorials, using both limited items and items available all year around with an aim to increase purchase intention.

2. SHISEIDO

Shiseido has a long-running history of innovation and creativity. It’s no wonder they have so many products to choose from. From eyeliners to blushes, lipsticks, and foundations, there’s something for everyone. It is one of the best luxury beauty brands in Japan. For those just starting out, try the Shiseido eyelash curler which will help to enhance your eyes as well as achieve a long-lasting curl that leaves your lashes looking spectacular all day long.

With its open-mindness to diversity, Shiseido is a pioneer brand to introduce men’s skincare products. Indeed, Shiseido urges women to buy skincare products as gifts for men this Valentine’s Day, and will hold its first men’s event at Ginza Mitsukoshi from 2nd February to 8th February this year.

3. FANCL

FANCL is a Japanese brand that produces cosmetics and supplements made with ingredients derived from soybeans. They believe that the best way to maintain healthy and resilient skin is to provide it with plenty of fresh air, or “breathing room” so to speak.

FANCL also has a product line in the health food and supplement section. Last year, for Valentine’s Day, they sold a limited number of heart-shaped beauty supplements. Following FANCL’s example, it is always important to review your product line and identify products that can be integrated into the Valentine’s Day event. The best items differentiate themselves from their competitors.

4. CANMAKE

Compared to brands listed above, the price range of CANMAKE is cheaper and incredibly popular among younger consumers, especially teenage girls who have just started wearing makeup. They do not run campaigns during the Valentine’s season, but this does not mean that they do not participate in the Valentine’s Commercial War. On their website, they provide a “makeup tutorial for Valentine’s Day” using their most-sold products.

And so, if you don’t have the budget for running campaigns for Valentine’s Day, introducing your products by using the concept of the Valentine’s Day like CANMAKE can be a great opportunity to increase sales and brand awareness in Japan.

If you are struggling to enter the Japanese market as a beauty brand, we can help you: we have experience working with leading beauty brands.

Read Tokyoesque’s case study in beauty, grooming & skincare sector here>> https://tokyoesque.com/industries-japan-market/skincare-market-in-japan/

The growth of the men’s grooming industry is immense

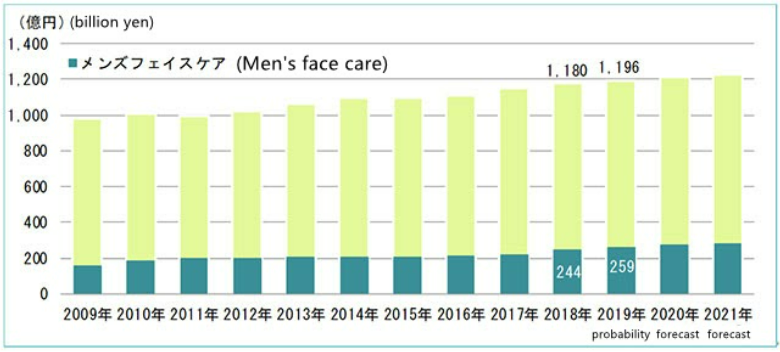

Recently, the Japanese beauty sector has seen an increase in male beauty products. This trend is notable in other Asian countries too, so when expanding your business to Japan, it is essential to take this into account as well as building on your traditional strategy.

As you can see from the chart above, it is becoming increasingly common for Japanese men to use skincare products. According to a recent study, the male beauty industry has seen substantial growth, where teenage boys typically spend around 5,610 yen (equivalent to 36.25 GBP) on skincare products. As the market size in the chart suggests, the skincare market for men is upward trending and scalable. To make the most out of this trend, one of the biggest department stores in Japan, Daimaru, is promoting men’s skincare products on their official website.

On the consumer side, you can see a large range of tips and techniques performed by men on TikTok. In fact, the hashtag #美容男子 (“beauty men”) has 60 million followers on TikTok.

Here are the top two Japanese beauty brands for men:

Bulk Homme

Bulk Homme is a DTC (direct to consumer) brand launched in 2013. They have all the basic products such as facial cleansers and facial kits. With countless brands, this brand has remained the 1st choice for many male consumers when it comes to skin care products. This brand sells a vision rather than products: it shares the male beauty standard’s across the world. In addition to skincare products, they also have cosmetic products for male consumers.

How is sustainability perceived in the Japanese beauty sector?

Although Japanese consumers have become more aware of sustainability in recent years, domestic beauty brands are still lagging behind their foreign counterparts in terms of sustainability. Here are examples of domestic beauty brands that place a focus on sustainability.

SHIRO

Japanese cosmetic brand SHIRO uses ingredients extracted from ancient and natural Japanese materials such as “sake lees” and “gagome kelp”. The brand has also introduced an “ethical discount” option, which allows customers to receive a discount in exchange for choosing products without a paper box. In addition, the products have an ethical appeal: they are not tested on animals. The brand’s popularity is not limited to the domestic market; it already has three shops in London and online shops in Taiwan and the US.

amritara

amritara is an organic cosmetic brand whose motto is “don’t put in what you don’t need” and “create what the world doesn’t have”. amritara’s skincare and make-up products are based on naturally grown herbs from farms in Kyushu and carefully selected organic plants from around the world. The brand adheres to its own strict “10 Promises” standards, such as not using synthetic surfactants or silicone oil, and even offers food and supplements that are carefully grown without the use of any pesticides.

Interestingly, all the wood used in their shop interiors is solid Japanese wood, the paints are natural paints made from linseed oil, sesame oil and iron oxide. Furthermore, some of the shops run on 100% green electricity generated by natural energy sources such as solar and wind power. The way the brand promotes sustainability not only through their products but also through the physical customer experience is cutting edge and worth keeping an eye on.

SDGs and sustainability are a hot topic in Japan, but consumers still do not always consider sustainability when purchasing cosmetics. This may be due to the “puchi pura” (low price) culture in Japan, where sustainability-conscious cosmetics tend to be sold at a higher price. In light of this, introducing sustainable cosmetics to the market that combine affordable price and quality would not only appeal to consumers, but would also be a big step forward for companies in the Japanese beauty sector.

Read : What’s a Powerful Strategy for Marketing Sustainability in Japan Post-Covid?

How can non-Japanese beauty brands be competitive in Japan?

Product Packaging:

Japanese consumers are gravitating towards green packaging which not only provides sales but also contributes to society. With respect to the Japanese consumers, they are looking for high-performance products, products with multi-appeal attributes, and pocket-friendly options. In the past, beauty brands lacked color combinations. That’s why they were not appealing enough but if we look at the options available today, famous beauty brands are looking for more pop-colors so that they can be more appealing. The packaging has also improved in terms of aesthetics which usually increases the sales.

Personal Colour Analysis:

In recent years, Japanese consumers are keen on knowing and analysing colours which suit them most before purchase. The so-called ‘personal colour diagnosis’ is an analysis of the natural colour of the skin, hair and eyes, and suggests suitable make-up and fashion based on the individual. This trend has been on the rise for a few years now, and there are even paid professional analysis services for this. Indeed, most beauty brands in department stores provide this service to customers over the counter.

Introducing AI service on the website, that suggests products which would work well with each customer’s personal style as they shop online would encourage their purchase intention. It will be necessary to envisage a customer’s decision making process that takes factors in colour diagnosis in order to be competitive in the market.

Personal colour analysis can be applied to all cosmetics products; foundation, concealer, eyeshadows, lipsticks and even nail polishes. As the pandemic has reduced face-to-face customer service opportunities, these new online customer assistance services will help to boost sales.

In this blog post, we focused on beauty products and the potential opportunities. We also looked at how certain beauty brands take advantage of Valentine’s Day , and how these campaigns are not only limited to cosmetic products.

Making the most out of seasonal events and localizing your marketing to the local customers is a great strategy for entering the Japanese market. Foreign brands who are interested in Japan should look into all the possible seasonal events that they can align with their products, as these events can help you create a bigger buzz when promoting your goods.

Kajal Gosain

Kajal Gosain is a Freelance Content Writer and Social Media Analyst, who is studying computer application. With her keen interests in the presence of the world and willingness to learn, she pays close attention to details in her life which enrich her strength as a content writer in the Beauty, Lifestyle, Travel niche.

Linked In: https://www.linkedin.com/in/kajal-gosain

Keep checking back or follow us on LinkedIn, Facebook or Twitter to get notified about our latest posts.

We’ll be adding more articles on seasonal and cultural occasions in Japan, so watch this space!