Consumer Insights

Consumer Insights

The Smart Speakers Market in Japan

By Melissa Francis

Amazon Alexa, Google Assistant and other leading smart speakers have become a convenient addition to many households around the world. But what’s the smart speakers market in Japan like right now?

Overview of the Smart Speakers Market in Japan

3.7 million households in Japan had smart speakers installed in 2018, but according to Statista’s forecast, this figure is expected to reach 22 million by 2024, seeing a 494% increase. According to research conducted by Fuji Research Laboratory, Japan’s overall smart homes market is likely to exceed $38 billion USD in value.

A Canalys report on the global smart speaker market states that Asia is set to see significant growth, and while China leads the curve, Japan and South Korea are close behind and due to experience rapid growth (132%) by the end of 2019. This is a higher rate than the US, UK and Germany.

Since their arrival in the Japanese market in 2017, Google and Amazon have launched products that are specifically tailored to the requirements of the Japan’s smart speaker market. Apple released its HomePod comparatively late in August 2019, but is targeting high-income consumers.

Dentsu Digital conducted a survey among 10,000 Japanese consumers and found that they use smart speakers primarily for the following purposes:

Listening to music (74.5%)

Getting the weather forecast (61.1%)

Setting an alarm or timer (55.3%)

Who’s Leading in Japan’s Smart Speakers Market?

The key players in Japan’s smart speaker market are currently; Google, Amazon, and LINE. Here’s a rundown of they’re doing to appeal to local audiences.

Google’s ads for the Google Home speaker are largely focused on family, but are always shown being used by the parents, particularly mothers, rather than their children. The ads also demonstrate a clear, practical usage for Japanese consumers specifically, by honing in on aspects like smart integration with appliances like air conditioning units. In one ad for Google Nest Mini, we see parents keeping their children entertained with stories from Disney’s hit film Frozen 2.

Amazon

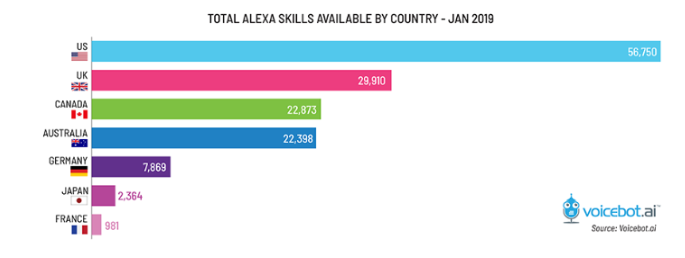

While Alexa possesses many more skills in English-speaking markets, Japan is still ahead of countries like France, and by October 2019 the skills had exceeded 3,000, so this is developing rather quickly and the Skills Blueprints became available in Japan earlier this year. The Echo Flex made its debut in the market in mid-November 2019. A local ad for the Amazon Echo faced significant backlash among Japanese consumers who considered it to be normalising disrespectful behaviour towards mothers (see our previous article on this).

Clova (LINE)

LINE’s Clova Friends and Clova Friends Mini smart speakers firmly target families with children with their approachable designs, ranging from well-known LINE characters, to TV favourites like Doraemon. Compared with Google and Amazon’s offerings, Clova was held back in terms of its ability to connect with third-party applications, but there appears to be some progress on this front with at least 300 additional skills available from the ‘Skill Store’ both from companies and independent developers. Clova has been advertised by members of pop group Nogizaka46 in a series of official commercials, demonstrating how some of the skills function practically as part of an everyday routine.

Cultural Barriers to Adoption

Japan is renowned for incorporating robots and other automated machines into everyday life to maximise convenience. Still, smart speakers aren’t something that were developed locally. With major US brands like Microsoft, Apple and Google being the key innovators in the market, there were a few cultural hurdles to overcome among Japanese consumers.

Embarrassment

In a study on voice search and AI, conducted by telecoms giant KDDI, 70% of Japanese respondents said they would find it embarrassing to activate a smart speaker using voice commands when other people were around. It was considered more of a solo-use situation. We’ve seen this with other similar products, such as the virtual holographic assistant by Gatebox, which presents a friendly anime-style projection designed to help combat loneliness as well as connecting to home appliances and offering useful information.

Feels strange using wake words

This one is more of a temporary barrier. At first, having to say ‘Alexa’ or ‘Hey Google’ was considered an alien concept to Japanese consumers. As LINE and Google invested heavily in TV promotions for their respective smart speakers, however, more people are now aware of this.

The design is unrelatable

Smart speaker designs may be sleek and stylish, but how can they be made softer? LINE has been competitive in this sense, because they’ve specifically made their smart speakers resemble popular characters. A huge number of Japanese people use the LINE messaging service and as such are familiar with the ‘LINE Friends’ animals. Doraemon is also a very recognisable face among locals, so aligning smart speakers with a cute, approachable image is a solid strategy.

Unable to envisage themselves using it

In the results of the aforementioned smart speakers survey, Dentsu Digital discovered that the top reasons that Japanese people do not own one are as follows:

- “I don’t want to use it until I’ve tried it out.”

“I can’t imagine what kind of use I’d have for it. It’s difficult to picture myself with one.”

“I’m okay as long as I have a smartphone, tablet or PC.”

So what’s on the horizon for Japan’s smart speakers market?

Major local players like Sony and Panasonic have also been expanding into the smart speaker market, but despite being trusted manufacturers, these brands are nowhere near as prominent as Amazon, Google and LINE in terms of overall market share. Sony has been accused of mimicking the design of the Apple HomePod design with its LF-S50G model (below). Japanese real estate agents are also looking to incorporate smart speaker systems into their IoT packages as demand for voice-activated gadgets increases as a standard feature. After all, convenience remains to be a key selling point in Japan. The Dentsu Digital survey on smart speakers also revealed that in terms of free features, Japanese consumers would most like a service that can intuitively read their mood and offer support accordingly.

Want to write a post for the Tokyoesque blog? We’re on the lookout for contributors who can write on various topics relating to the Japanese market. Have a look through the topics we’ve already covered and let us know if you have something to offer. Essentially, these relate to consumer insights, your experience working in or expanding to Japan, or industry-specific insights.

Please contact us to discuss your idea further.