Industries

Industries

The Mouth-watering Success of Japan’s Ice Cream Market

By Emma Regan

Ice cream has always been a worldwide favourite when it comes to the variety of delicious confectionery on offer. Believed to have originated circa 200BC, where Alexander the Great would enjoy a mixture of snow and ice, flavoured with honey and nectar, the milk-based ice cream we are familiar with originated from China during the Tang period. It spread through Europe between the 16th and 17th century and continued to grow into what we know it as today. Japan’s appreciation for ice cream occurred during the 20th century, yet was perceived as a luxury.

So how did Japan’s ice cream market open up and become known as the world’s top ice cream innovator? Here we give a cultural insight into the different types of Japanese ice cream brands, products, flavours, as well as opportunities within Japan’s ice cream market.

Overview of Japan’s Ice Cream Market

Ice cream in Japan can be sold in numerous ways: impulse, take-home and bulk, soft-serve parlours, and vending machines, with hypermarkets and supermarkets being the leading distributor. The wide variety of products induces a greater chance of selling, along with the extensive selection of unique flavours on offer.

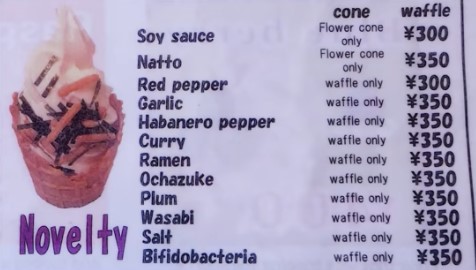

Examples vary with traditional Japanese flavours such as matcha, sweet potato, cherry blossom, brown tea, and more unconventional ones such as mayonnaise, seaweed, natto, and even garlic. Japan’s ice cream sector is currently led by impulse ice cream, however, take-home and bulk ice cream are expected to register the fastest value growth within the upcoming years. The increasing consumption of ice cream during the winter months is the cause of this.

The ever-growing popularity of Japanese cuisine has certainly helped too, opening up not just Japan’s ice cream sector, but other snacks and confectionery as well. Japan’s ice cream revenue halfway through 2020 was $13,430.5 million and came in as the second-largest confectionery revenue after Preserved Pastry Goods and Cakes.

The largest confectionery companies in Japan also offer as the largest players within Japan’s ice cream market; Lotte Co, Ezaki Glico, Morinaga Milk, and General Mills. They have renovated and rejuvenated Japan’s ice cream sector by expanding their companies out, as well as focusing on gaps within the country’s market itself.

Companies Leading Japan’s Ice Cream Market

Lotte Co

Ice cream in Japan was limited to being sold within the summer months for an extensive period, yet that changed in the 1980s due to the groundbreaking innovation created by the Korean company, Lotte Co. The company noticed a gap within Japan’s ice cream market and decided to create a winter dessert called Yukimi Daifuku- mochi ice cream.

It was developed shortly after their first attempt at opening up Japan’s ice cream sector through the product Wataboshi– a marshmallow-coated ice cream that was a hit among teenagers at the time. The company wanted to expand the market even further by opening it up to the older generations, thus Yukimi Daifuku was created.

The name Yukimi Daifuku itself indicates how people should eat the yummy dessert- by eating it in indoors and watching the snowfall outside, a twist on the phrase ‘tsukimi daifuku’. To do this, the company developed a new recipe for mochi that would not harden in low temperatures. They also opted for different packaging, changing the industry standard of using blue, to using red, emphasising the warmth tone they were going for.

It became the country’s sought-after winter dessert, opening up Japan’s ice cream sector as desired. As of 2018, it is now available all-year-round in many traditional Japanese flavours, as well as luxury chocolate, and often collaborates with characters and food brands.

Not only did Lotte Co contribute to this gap, but it is also one of the leading companies within Japan’s ice cream market and was the largest player in 2019. It owns and produces the largest selection of ice cream bars, cones, cups, popsicles and tubs, and has been at the front of the confectionery industry for over 5 decades.

Ezaki Glico

Ezaki Glico, the Japanese company famous for its signature chocolatey biscuit Pocky, was recorded as the second-largest player in Japan’s ice cream market as of 2019. Founded in 1922, it is known for contributing to children’s physical and mental health, by striving to make their confectionery innovative and nutritious.

It also established the Maternal and Child Health Association. The company started selling ice cream in 1953 and is known for tasty products such as; Giant Cone, Papico, Panapp, and Ice no Mi. They have a calorie control ice cream series and their ice cream brand Sunao currently offers 50% less sugar for five of their flavours.

Ezaki Glico is also known as the ‘trailblazer’ in Japanese confectionery companies for expanding into foreign markets. They expanded their ice cream production in 2016 to both Thailand and Indonesia, after being worried about the ageing population in Japan. The company already had products within Thailand’s market, however, they started from scratch when attempting to break Indonesia’s. It was also stated back then that ice cream accounted for 23% of their sales and their overseas businesses accounted for 12.8% of total sales.

“Our company’s strengths is the development of power to create unique products that don’t exist in the current market.”

– Mikio Kusama, Managing Executive Officer

Morinaga Milk and General Mills

Other big companies within Japan’s ice cream industry are Morinaga Milk, known for its creamy dairy products such as Pino, Parm, and Mow, and General Mills, owners of Häagan-Dazs. They all do exceptionally well within Japan’s ice cream sector, especially with the American brand Häagan-Dazs also playing into the traditional Japanese flavours, offering a wide range of 30 different limited edition flavours annually. Some of these have spanned from ruby cocoa, azuki, sakura, lemon ginger, cookies and green tea, and even carrot and orange. They have even created their version of the sensational mochi ice cream.

The company uses the cultural influence of the many seasonal events in Japan to their advantage, keeping up with the marketable opportunities presented. Just recently, they announced their brand new autumnal flavour which is set to be a triumph, Hanamochi Kuri An, a chestnut sweet bean mochi ice cream. It is made with white Anko and will be accompanied by a salty chestnut sauce. Häagan-Dazs are also bringing back a signature favourite, Hanamochi Ginse Kinako Kuromitsu. Both are available from September 29th.

Japan’s Soft Cream

While impulse and take-home and bulk ice cream are currently dominating Japan’s ice cream sector, soft-serve ice cream parlours are just as popular and if not more eccentric when it comes to the variety they present. They are local businesses making use of local ingredients within their prefecture and aim their products at the local community along with tourists.

Musashi

Located in Iwakuni City, Yamaguchi, this soft-serve ice cream shop has the largest variety in Japan, with a staggering 140 flavours to choose from, yet it is the novelty flavours that really make the shop stand out. Founded in 1998 with only 6 flavours available at the time, it has been featured on Japanese television several times and is said to use an American blender to help create such a variety of flavours.

Milk Mura

Located in Sapporo, Hokkaido, this soft-serve ice cream bar is 1 out of 3 ice cream bars in the area, yet it’s the use of local ingredients to tie it into Japan’s heritage that has made it so admirable. The vanilla ice cream is made from high-quality Hokkaido milk and is then drizzled with the customer’s preference of liqueur, chosen from the hundred varieties of alcohol on display. Being the home prefecture to Japan’s top-selling beer brand, the ice bar combines Japan’s ice cream and liquor sectors together well, making it a guaranteed success.

Hakuichi Higashiyama Store

Situated in Kanazawa, Ishikawa, the city is known as Japan’s ice cream capital with records showing households spending over 10,000 yen per year during 2008-2017. This ice cream store not only caters to the sweet-tooth lovers, but also buys into the city’s biggest distribution- gold leaf. The translation literally meaning “golden marsh”, Kanazawa produces 98% of Japan’s gold leaf and is the sole remaining production hub. The gold leaf soft-serve ice cream is incredibly popular and customers can browse the store’s collection of other gold leaf items.

Vegan Ice Cream in Japan

Veganism is becoming increasingly popular all around the world, whether it’s due to the shifting trend in lifestyle, or the increasing acceptance and of lactose intolerance and other allergies, the vegan ice cream market is no different. It accounts for an increasing proportion of global ice cream launches, making up 7% of all launches between 2019-2020.

Japan is somewhat lacking in terms of its vegan ice cream selection. It currently has a variety of non-dairy fruit bars, gelatos, ice creams in the mainstream market, yet some contain ingredients which may be animal-derived and there are no vegan frozen yoghurts. They are also not available all year round, with the vegan frozen confectionery being more popular in the heat of the summer.

The most popular and easiest to find frozen vegan treats are Garigari-Kun, Japan’s top-selling popsicle by the company Akagi Nyugyo. Virtually unknown overseas, it thrives in Japan’s ice cream sector next to Lotte Co, Ezaki Glico, and Morinaga Milk, with 400 million being consumed annually by the Japanese population. The tasty icy treat comes in a whole range of flavours, with cola, strawberry, pink grapefruit, and pineapple being amongst the ones suitable for vegans.

For more information regarding veganism in Japan, we give a deeper analysis of Japan’s vegan sector here.

Japan’s Ice Cream Expo

Ice cream is so popular in Japan that it even has its own exhibition! Apiku CHIBA is the largest ice cream event in Japan, with over 2.8 million visitors per year, and takes place over the span of 5 days. This year it is running from 15th October to 20th October on the 6th floor of the Funabashi Store in Chiba Tobu Department Store.

Various local ice creams from all over the country will be gathered, from soft-serve, shaved ice (kakigori), gelato, and cup ice cream. The event will also be offering cold storage bags, so you can take the ice cream purchased home.

Opportunities in Japan’s Ice Cream Sector

Japan’s ice cream market has grown from strength to strength in recent years, thanks to the increase of winter products on sale and the expansion of Japanese companies towards the foreign market. However, there is still room to grow even further, with the inclusion of vegan ice cream, as well as new and innovative flavours companies and parlours have yet to dare try.

Related: Rising Success in the Japan Bakery Market

Keep checking back or follow us on LinkedIn, Facebook or Twitter to get notified about our latest posts. We’ll be adding more articles on Food and Beverages, so watch this space if this is an industry you’re interested in!

Alternatively, feel free to get in touch and see how we can help you develop in Japan’s ice cream market.