Industries

Industries

Localise European Food and Drink in Japan Effectively

By Melissa Francis

Japan is the fourth largest market for EU agri-food products and with the Japan-EU EPA in force since February 2019, European food and drink in Japan can enjoy a more notable presence as producers take advantage of the revised tariffs and rules. According to the European Commission, the total value of the European agri-food exports to Japan is around €6.6 billion EUR.

Here, we explore how Japanese companies and organisations are promoting Europe by importing goods from regional producers, but also how the very idea of something being ‘European’ as a concept can be a key selling point for Japanese consumers even when the items are not necessarily authentic.

Revamping the image of European food and drink in Japan

Do you know Saizeriya? It’s a chain restaurant that is popular throughout Japan. Their whole brand image capitalises on ‘Italian-ness’, from the decorations to the menus. The most ‘classic’ Saizeriya menu item is undoubtedly the “Milan-style Doria (ミラノ風ドリア/mirano-fu doria), which is a type of rice casserole. This dish doesn’t actually exist in Italy, but it is claimed to be from Milan and therefore makes it seem more authentic, whilst suiting the Japanese palette. Although Doria is very similar to French gratin, the dish was invented in Japan for local consumers and popularised in places like Saizeriya, which are classed as ‘family restaurants’.

Marin Food produces a margarine called watashi no furenchi toosuto (‘my French toast’), a margarine that is steeped in the flavour of French toast, one of the most famous French-style dishes to make at home. There was also an Instagram campaign running between May and July related to the product, which encouraged followers to post images of their French toast creations. Ten winners would be selected to receive a 10,000 JPY (around €82 EUR) gift certificate for Marin Foods as well as a freshly baked cake.

The Japanese know that Belgium is famous for chocolate and waffles. Manneken is a local Japanese brand of waffles that is designed to mimic the Belgian style. They actually use the term ‘Belgian waffles’, but some of the flavour combinations such as the limited edition ‘White Peach Cream Waffle’ are much more Japanese in nature. Manneken is clearly deviating from what would be considered traditionally Belgian and instead caters specifically to local tastes, while still maintaining the conceptual allure of Belgium.

Seeking out authenticity from European Food and drinks in Japan

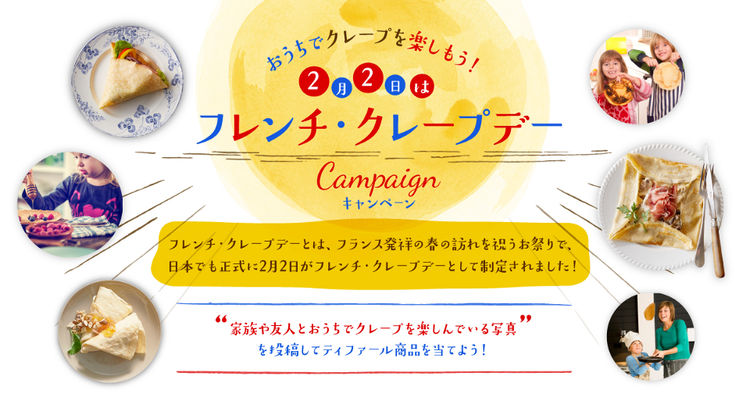

French kitchenware brand Tefal launched a ‘French Crepe Day’ campaign in February 2019, which encouraged social media users to snap photos of themselves cooking and eating crepes, along with the hashtag #2月2日はフレンチクレープデー (2nd February is French Crepe Day). Once the campaign period had finished, ten winners of 40,000 JPY worth (roughly €330 EUR) of Tefal goods were selected from those who participated.

The campaign brought a dose of authenticity to Japanese consumers as 2nd February is traditionally an occasion when friends and family in France get together to cook crepes. This is one effective way of engaging consumers in an activity that not only works to boost Tefal’s brand awareness, but promotes immersion into one aspect of French culture without physically having to travel to France.

Highlighting ingredients from a specific European region can be a really important way of promoting goods in Japan. Consumers are becoming more and more educated about various agricultural production areas, particularly smaller niche towns, and therefore actively seek out offerings that give them the opportunity to sample authentic food and beverages. For instance, Japanese manufacturing company Pokka produces a lemon juice made using 100% fresh Sicilian lemons.

In their marketing, this fact is strongly emphasised as an indicator that the ingredients are the best. Pokka ran a related campaign in May 2019 in which Reiko Sato, a Japanese chef living in Sicily introduced cooking with Sicilian lemon juice to Japanese audiences. Enlisting a Japanese chef with significant experience and credentials in Italy is preferable over a local, unfamiliar Italian name.

Toast to France! The Art of a Full Glass was a campaign run on the Japanese website of France.fr It sought to ‘offer a luxurious French journey throughout 2019, where you will be thrilled by new discoveries and thoroughly enjoy the depths of regional art and fine wines.’ It featured ‘France Experience Reporters’, Japanese natives living or travelling within the Normandy and Centre-Val de Loire regions of France who could report on their personal experiences of French culture and their recommendations. This creates appeal on more of an ‘everyday life’ level by offering endorsements based on the real experiences of non-famous Japanese people.

Although Spanish cuisine is comparatively less popular among Japanese consumers in the grand scheme of European food and beverages, there are some specialist events being held to promote the country. For example, FINE DINING & LOUNGE TORIKO at Rei Hotel in Kobe is holding a ‘Spain Fair’ as part of the seventh shoku no sekai ryokou ni dekakeyo (‘let’s go on a world food trip’) fair. Last year’s instalment proved to be especially popular, so they decided to bring it back again this time round. It will run from the beginning of July until the end of September 2019 and places a significant emphasis on seafood and meat dishes.

Even localised Google ads focus on ‘stylish’ European food

A Google advert localised for the Japanese market positions European cuisine, particularly Italian and French, as a desirable choices when dining out. We can hear two female friends having a conversation in the voiceover. They are discussing where they should go to eat. One suggests kaitenzushi(conveyor belt sushi), but the other says she doesn’t feel like it and instead recommends something ‘stylish’ like pasta, pizza or…”how about French?” Her friend laughs and says “French? That’s so grown-up! Can we even go to a French restaurant dressed like this?” (referring to their casual clothes).

They proceed to search for an easygoing, laidback French restaurant and quickly find one they like, exclaiming “Ah, this place is so cute! I bet the food is delicious there! I can tell just by looking at the interior.” It should be noted that French cuisine is commonly preferred by Japanese women as it is perceived to have a high-class, luxurious feel about it.

Lesser known European regions get promoted too

While Italian and French are arguably the highest performing European cuisines in Japan, there is also a growing interest in lesser known countries, such as Bulgaria. Take for instance, Meiji’s ‘Bulgaria Yogurt’ range, which has been around for a long time and is one of the best-selling yogurt brands in Japan. It was founded after one of Meiji’s staff members tasted authentic Bulgarian yogurt at Osaka Expo in 1970. The company was also the first to release a plain yogurt in Japan, soon gaining permission to officially change the product name to ‘Bulgaria Yogurt’.

The marketing has since highlighted the culture of Bulgaria in relation to the production and consumption of yogurt and this helps to lend more of a human touch to the brand image. It is claimed to be the most authentic tasting Bulgarian-style yogurt in Japan. The website also provides a lot of detailed information about the country.

Spotlight on Italian cuisine in Japan

When it comes to thinking about European food, Italy is often top-of-mind among Japanese consumers. The value of Italy’s total exports to Japan is approximately €1 billion EUR (of €10 billion EUR worth of exports from all industries combined). Italian hard cheeses other than parmesan are especially seeing high levels of growth, with an estimated 28% year-on-year increase from 2018 to 2019.

The Italian Embassy and the National Supermarket Association of Japan (NSAJ) are teaming up to promote Italian recipes that aims to boost sales of Italian ingredients among Japanese consumers. The project is dual phased, with the first phase running between October 2019 and March 2020, and the second between April 2020 and February 2021. As of 23rd April, five domestic supermarket chains have been confirmed to be participating in the promotional scheme. These are namely; Aoki Co., Ltd., Ikairi Supermarket Co., Ltd., M I Foodstyle Co., Ltd., Odakyu Shoji Co., Ltd., and Kinokuniya Co.

In July 2019, the ‘Italy Festival’ took place in Tokyo, this year dubbed ‘amore mio!’ (my love!) Organised by the Italian Chamber of Commerce in Japan, this doesn’t only showcase culinary delights, it also sees well-known Italian and Japanese guests from a wide range of industries attending. The event coincides with the Japanese tanabata festival, which celebrates the love of mythical star-crossed lovers Vega and Altair — hence the focus on ‘romance’ as the central theme. ‘Italy Festival’ is sponsored by a wide range of Italian companies, including Ferrero Rocher and Peroni.

‘World Italian Cuisine Week’ is held by the Italian Embassy every November. Along with key visuals, posters, stickers etc. there will also be a range of recipe cards and tutorial videos available in participating supermarkets throughout the campaign to provide consumers with extra inspiration to cook Italian dishes. There will also be business matching opportunities for Italian businesses looking to export their food and drink goods to Japan at the Anuga Fair 2019 in Cologne, Germany.

So what are the key takeaways for European F&B brands looking to appeal to Japanese consumers?

There are two main approaches to promoting European food and drink in Japan.

Firstly, brands can focus on the regional value of their products. What is special or unique about a particular production area? Nowadays, it’s not only the major areas like Sicily, Bordeaux that are making waves among Japanese gourmands. Locals are increasingly gaining a keener nose and appetite for smaller, independent makers and products from areas that had not been so notorious until now. Consider what kinds of defining characteristics, processes, stories or case studies associated with your brand that can be successfully communicated to a Japanese audience. Are there any interesting points that can be linked with familiar aspects of Japanese culture? (take the tanabata example demonstrated by the Italy Festival for instance).

The second method is to really hone in on the idea of making ‘European products specifically for the Japanese market’ by partnering with Japanese manufacturers to produce brand new goods that resonate with local consumers. This could be in terms of manufacturing methods, ingredients, flavour combinations, or recruiting popular tarento (celebrities) / renowned chefs for marketing communication with impact.

Are you representing a food / beverage brand operating in Europe and looking to expand into the Japanese market? Or perhaps you’re already present in Japan and want to know how to create more appeal with your marketing strategy. In either of those cases, just let us know!

Contact us to find out how we can help.