Interviews

Interviews

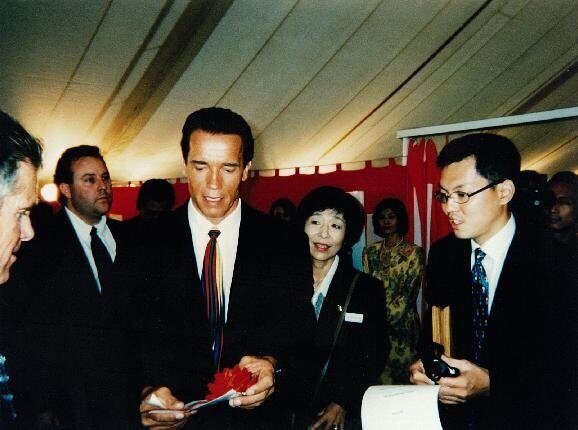

Interview with Akio Fujii, Japan M&A Specialist

Japan M&A transactions have been on the rise. Since 2014, the number of outbound M&A (Merger & Acquisition) transactions from Japan increased by 58% to reach a total of 720 deals in 2019 with Asahi Group’s acquisition of Australian drinks giant Anheuser-Busch Inbev SA/NV topping the list at a value of $11.3 billion USD. 40% of the top ten outbound deals were made with European companies.

As for inbound transactions, only one of the highest ranking deals was made by a European company (Sandoz International GmbH’s acquisition of Aspen Japan KK at a value of $441 million USD), with the key companies being Japan’s Softbank and South Korea’s NAVER Corporation who increased their existing 73% stake in LINE Corporation to a complete acquisition at a value of $3.4 billion USD in December 2019.

This week, we were fortunate to have the chance to speak with Akio Fujii, a longstanding specialist in working on Japan M&A, both between Japanese companies as well as between Japanese and global companies. He kindly agreed to give us the low-down on his key professional endeavours, experiences in the M&A world, and some advice for foreign businesses looking to do deals in Japan.

Check out his latest article over on LinkedIn entitled ‘What it Takes to Change Japan’.